David Cameron last night bowed to a week of political pressure and disclosed that he had made money from an offshore fund.

After days of semi-denials and artfully crafted statements, the prime minister admitted that he and his wife sold shares of than £30,000 in an offshore fund set up in Panama by his father, who died in 2010.

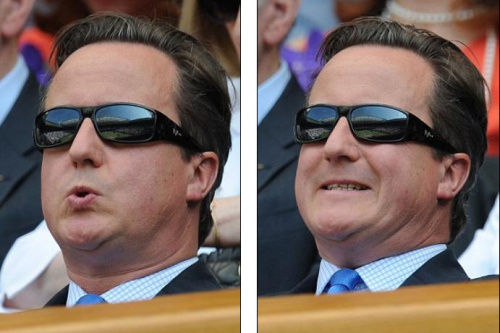

The admission on ITV News was an awkward moment for Mr Cameron, whose slowly evolving response to the Panama Papers had led Labour to claim he had something to hide.

Mr Cameron revealed that in 1997 he and his wife Samantha bought a holding in Blairmore, a fund set up in the early 1980s by Ian Cameron with the help of Mossack Fonseca — the Panama law firm that had 11.5m documents leaked to the press.

Downing Street said the original holding was of £12,497 and was sold in January 2010 for £31,500, just months before he became prime minister.

Mr Cameron said he had paid income tax on the dividends but there was no capital gains tax because the profit was less than the couple’s allowance.

Downing Street initially said questions about any offshore interests held by Mr Cameron were “a private matter”, while later he said that neither he nor his wife or children stood to benefit from an offshore fund.

Mr Cameron’s statement confirmed that he had indeed benefited from Blairmore, although he insisted it was not a tax-avoidance vehicle. He also admitted some of his £300,000 inheritance had come from offshore wealth.

If the wider Cameron family do still hold Blairmore stakes, they might regret it. Over the past five years the fund is down 7.6 per cent, while the FTSE All World index is up 32.7 per cent over the same period.